Assessor's Office

Assessor’s Office

Business Hours: Monday – Friday | 7am – 4:30pm | Subject to Cass County Holidays

Cass County Courthouse

5 West 7th Street

Atlantic, IA 50022

(712) 243-2005

Important Information

Please provide all relevant data including photos or video with your petition.

Completed forms with supportive data can be emailed to assessors@casscoia.us or mailed to 5 W 7th, Atlantic, Iowa 50022.

If the Board of Review needs additional information, a representative from the Assessor’s office will contact you.

The formal appeal period has been extended and will now be April 2-April30th.

Thank you for your patience and understanding as we adapt to this ever changing environment.

The Board of Review will meet May 2nd-adjournment

Downloadable Forms

Downloadable forms used in the Assessor’s office

- Property Assessment Tax Flow Chart.pdf

- Family Farm Tax Credit Form

- Business Property Tax Credit Form

- Iowa Homestead Tax Credit Form

- Military Exemption Form

- Informal Review and Proposed Valuation

- Petition to Local Board of Review – Regular Session (Disaster Counties Version during COVID-19)

- Petition to Local Board of Review – Regular Session

- Petition to Local Board of Review – Equalization Session

CONFERENCE BOARD MINUTES

Duties of the Assessor

The Assessor is charged with several administrative and statutory duties. The primary duty and responsibility is to assess all real property within the Assessor’s jurisdiction except that which is otherwise provided by law. This would include residential, multi-residential, commercial, industrial, and agricultural classes of property.

Real property is revalued every two years. The effective date of the assessment is January first of each year. The Assessor determines a full or partial value for all new construction and improvements depending upon their state of completion as of that January first date

The Assessor is concerned with value, not taxes. Taxing jurisdictions such as schools, cities and county, adopt budgets after public hearings. This determines the tax levy, which is the rate of taxation required to raise the money budgeted.

The taxes you pay are proportional to the value of your property compared to the total value of property in your taxing district.

The Assessor DOES NOT:

- Collect taxes

- Calculate taxes

- Determine tax rate

- Set policy for the Board of Review

About the Assessor:

- Assessors are appointed to their position by a Conference Board consisting of the members of the Board of Supervisors, the Mayors of all the incorporated cities, and a member of each school district within the jurisdiction. A city with a population of 10,000 or more may elect to have their own assessor.

- In cities having an assessor the conference board shall consist of the members of the city council, school board and county board of supervisors.

- Assessors are required by law to pass a state examination and complete a continuing education program consisting of 150 hours of formal classroom instruction with 90 hours tested and a passing grade of 70% attained. The latter requirement must be met in order for the Assessor to be reappointed to the position every six years.

- The Conference Board approves the Assessor’s budget and after a public hearing acts on adoption of the same.

- The Assessor is limited, by statute, depending upon the value of the jurisdiction, to a levy limitation for the budget.

Market Value, Tax Levies and Assessed Values

WHAT IS MARKET VALUE?

Residential, commercial and industrial real property are assessed at 100% market value. Market value of a property is an estimate of the price that it would sell for on the open market on the first day of January of the year of assessment. This is often referred to as the “arms length transaction” or “willing buyer/willing seller” concept. The Assessor must determine the fair market value of real property. To do this, the Assessor generally uses three approaches to value.

Market Approach – The first approach is to find properties that are comparable to the subject property and that have recently sold. Local conditions peculiar to the subject property are then considered. In order to adjust for local conditions, the Assessor also uses sales ratio studies to determine the general level of assessment in a community. This method is generally referred to as the MARKET APPROACH and is usually considered the most important in determining the value of residential property.

Cost Approach – The second approach to value is the COST APPROACH, which is an estimate of how many dollars at current labor and material prices it would take to replace a property with one similar to it. In the event the improvement is not new, appropriate amounts of depreciation and obsolescence are deducted from replacement value. Value of the land is added to arrive at an estimate of total property value.

Income Approach – The INCOME APROACH is the third method used if the property produces income. If the property is an income producing property, it could be valued according to its ability to produce income under prudent management; in other words, what another investor would give for a property in order to gain its income. The income approach is the most complex of the three approaches because of the research, information and analysis necessary for an accurate estimate of value. This method requires thorough knowledge of local and national financial conditions, as well as any developmental trends in the area of the subject property being appraised since errors or inaccurate information can seriously affect the final estimate of value.

Agricultural real property is assessed at 100% of productivity and net earning capacity value. The Assessor considers the productivity and net earning capacity of the property. Agricultural income as reflected by production, prices, expenses, and various local conditions is taken into account.

WHY VALUES CHANGE

After properties have been appraised, the values are analyzed to ensure accurate and equitable assessments. Iowa law requires that all real property be reassessed every two years. The current law requires the reassessment to occur in odd numbered years. Changes in market value as indicated by research, sales ratio studies and analysis of local conditions as well as economic trends both in and outside the construction industry are used in determining property assessments.

IMPORTANT DATES

January 1 – Effective date of current assessment.

April 7 through May 5 inclusive – Protest of assessment period for filing with the local Board of Review.

May 1 through adjournment – Board of Review meets each year.

October 16 through October 25 inclusive – Protest period for filing with Board of Review on those properties affected by changes in value as a result of the Director of Revenue and Finance Equalization Orders (odd numbered years).

January 1 through December 31 – Period for filing for Homestead Credit and Military Exemption. One time filing is provided, by statute, unless the property owner is (1) filing for Military or Homestead Credit the first time; (2) has purchased a new or used home and is occupying the property as a homestead as of July 1st; or (3) owner was using as a homestead but did not previously file. If the home qualifies and the property owner files on or before July 1, the exemption will go into effect for the current assessment year. If the property owner files after July 1, the exemption will go into effect the year following the sign up.

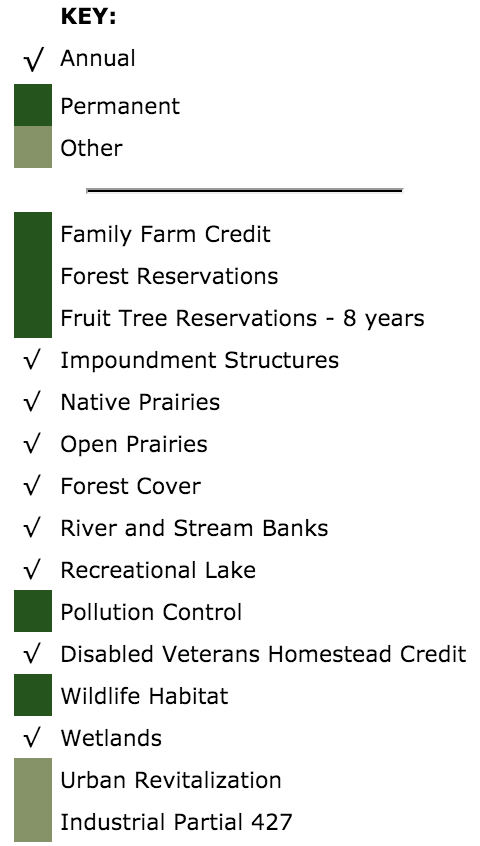

Filing is required on the following, if provisions have been made for exemptions as required:

Notification and Appeal

If you disagree with the Assessor’s estimate of value, please consider these two questions:

- What is the actual market value of my property?

- How does the value compare to similar properties in the neighborhood?

If you have any questions about the assessment of your property, please contact your assessor’s office.

A written protest may be filed with the Board of Review which is composed of either three members or five members from various areas of the county who are familiar with local market conditions and trends. The Board operates independently of the Assessor’s office and has the power to confirm or to adjust upward or downward any assessment. An individual may petition to district court if they are not satisfied with the Board of Review’s decision.

Assessor’s Links

- Vanguard Appraisals

- Beacon

- Iowa State Association of Assessors

- Iowa State Association of Counties (ISAC)

- Iowa General Assembly Bills and Amendments

- The Iowa General Assembly: Iowa Law

- Iowa Administrative Code

- Iowa Department of Revenue

- IAAO: International Association of Assessing Officers

Other Related Links